Retiring in Japan has become an increasingly attractive option for many Americans seeking a unique blend of traditional culture and modern convenience in their golden years.

With its excellent healthcare system, low crime rates, efficient public transportation, and rich cultural heritage, Japan offers a high quality of life that appeals to many retirees from the United States.

However, the path to retirement in the Land of the Rising Sun isn’t as straightforward as in countries like Mexico, Portugal, or Thailand that actively court foreign retirees.

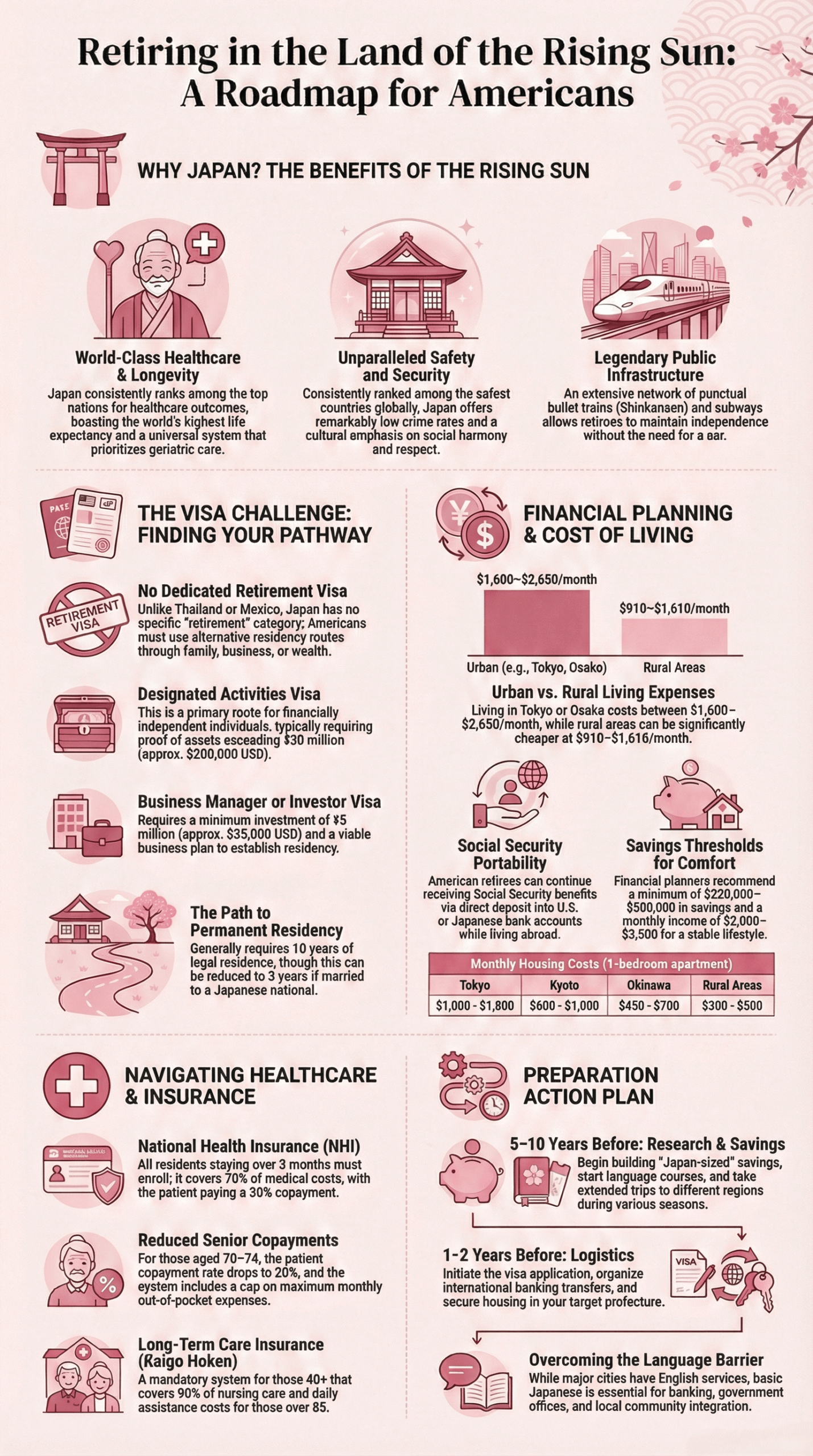

The most significant hurdle Americans face when considering retirement in Japan is the absence of a dedicated retirement visa.

Unlike many popular retirement destinations, Japan does not offer a specific visa category for retirees, which means Americans must pursue alternative pathways to establish long-term residency.

Despite this challenge, retiring in Japan remains entirely possible with proper planning and financial resources. Many Americans successfully navigate the Japanese immigration system through various alternative options, including:

- Obtaining residency through family connections

- Securing long-term business or investor visas

- Qualifying for permanent residency after years of living in Japan

- Utilizing the “Designated Activities” visa for financially independent individuals

The financial aspect of retiring in Japan also requires careful consideration. While Japan’s cost of living varies significantly between Tokyo’s bustling metropolis and quiet rural towns, prospective retirees should be prepared for expenses that generally exceed those in many other Asian retirement destinations.

Healthcare, while excellent, requires enrollment in the national insurance system, and housing practices differ substantially from American norms. Cultural adaptation represents another important consideration.

Japan’s unique social customs, language barrier, and distinct business practices can present adjustment challenges for Americans accustomed to Western norms. However, many retirees find that embracing these differences leads to a deeply rewarding retirement experience.

Throughout this guide, we’ll explore the practical, financial, and cultural aspects of retiring in Japan as an American. We’ll examine visa pathways, financial requirements, healthcare options, ideal locations, and strategies for overcoming common obstacles.

While the journey requires more planning than some retirement destinations, many Americans find that the rich cultural experience and high quality of life make Japan worth the extra effort.

Why Consider Japan as a Retirement Destination?

Japan has emerged as an increasingly attractive retirement destination for Americans seeking a blend of modern convenience, cultural richness, and high quality of life.

While countries like Thailand and the Philippines have traditionally dominated the Asian retirement landscape, Japan offers several distinct advantages that make it worth considering for your golden years.

High-Quality Healthcare System

Japan boasts one of the world’s most advanced healthcare systems, consistently ranking among the top nations for healthcare outcomes and longevity.

Japanese citizens enjoy the world’s highest life expectancy—a testament to the quality of medical care available. For retirees, this means:

- Universal healthcare coverage through the National Health Insurance (NHI) system

- State-of-the-art medical facilities with advanced technology

- Highly trained medical professionals with expertise in geriatric care

- Affordable prescription medications compared to the United States

- Preventive care emphasis that supports healthy aging

Many hospitals in major cities have international departments with English-speaking staff, making the transition easier for American retirees.

Safety and Low Crime Rates

Japan consistently ranks among the safest countries in the world, with remarkably low crime rates that provide peace of mind for retirees. Walking alone at night in most Japanese cities feels secure in a way that’s rare elsewhere. This exceptional safety record stems from:

- Strong community ties and social cohesion

- Effective policing and law enforcement

- Cultural emphasis on respect and social harmony

- Low gun ownership and strict weapons control

- Natural disaster preparedness infrastructure

For retirees, this safety translates to freedom of movement and reduced stress about personal security—a significant quality-of-life enhancement.

Rich Culture and Natural Beauty

Few countries offer the depth and diversity of cultural experiences that Japan provides. From ancient temples to cutting-edge technology, Japan presents an intriguing blend of traditional values and modern innovation:

- Thousands of years of documented history and preserved traditions

- Seasonal festivals (matsuri) and cultural celebrations

- World-renowned cuisine recognized as UNESCO Intangible Cultural Heritage

- Traditional arts like ikebana (flower arrangement), tea ceremony, and calligraphy

- Four distinct seasons showcasing different aspects of natural beauty

Japan’s geography offers everything from snow-capped mountains and volcanic hot springs to subtropical beaches and bamboo forests. The country’s 34 national parks provide endless opportunities for outdoor recreation and nature appreciation.

Efficient Public Transportation

Japan’s transportation infrastructure is legendary for its efficiency, punctuality, and coverage. For retirees who may eventually prefer not to drive, this network offers unparalleled mobility:

- Extensive rail system connecting even remote areas

- Famously punctual bullet trains (Shinkansen) for intercity travel

- Comprehensive subway networks in major cities

- Reliable bus services filling gaps between train routes

- Senior discount passes making travel affordable

This transportation network eliminates the isolation that can sometimes accompany aging, allowing retirees to maintain independence and mobility without relying on driving.

Comparison to Other Asian Retirement Destinations

While Thailand and the Philippines have long been popular with American retirees due to their lower costs of living, Japan offers distinct advantages:

| Factor | Japan | Thailand | Philippines |

|---|---|---|---|

| Healthcare quality | Exceptional | Good in major cities, variable elsewhere | Variable, best in private facilities |

| Safety | Very high | Moderate, varies by region | Moderate, varies significantly by region |

| Infrastructure | World-class | Developing, good in tourist areas | Developing, inconsistent |

| Visa process | Complex, no specific retirement visa | Straightforward retirement visa | Easy retirement visa program |

| Cost of living | Higher | Lower | Lower |

| English proficiency | Moderate in cities, limited elsewhere | Good in tourist areas | Widespread |

While Thailand and the Philippines offer more accessible visa pathways and lower costs, Japan provides superior infrastructure, healthcare, and safety—qualities that often become increasingly important as retirees age.

For Americans seeking a retirement that combines cultural stimulation, modern convenience, and peace of mind, Japan offers a compelling alternative to more traditional Asian retirement destinations.

The higher cost of living is balanced by exceptional quality of life factors that contribute to healthy, active, and fulfilling golden years.

Visa and Residency Options for American Retirees

One of the first challenges Americans face when considering retirement in Japan is understanding the visa situation. Unlike countries such as Malaysia, Thailand, or Portugal, Japan does not offer a dedicated retirement visa program.

However, this doesn’t mean retiring in Japan is impossible—it simply requires more strategic planning and understanding of alternative pathways.

Available Visa Options for Retirees

Since there’s no specific “Japan retirement visa,” Americans must pursue one of several alternative routes:

1. Spouse or Family Visa (配偶者ビザ)

If you’re married to a Japanese national or have Japanese children, this is often the most straightforward path.

- Duration: Initially 1-3 years, renewable

- Requirements:

- Marriage certificate or family registry documentation

- Proof of relationship

- Financial stability documentation

- Sponsor letter from Japanese spouse/family member

2. Long-Term Resident Visa (定住者)

This visa is sometimes available to those with special ties to Japan or unique circumstances.

- Duration: 1-5 years, renewable

- Requirements: Varies case-by-case but typically requires demonstrating significant ties to Japan

3. Designated Activities Visa (特定活動ビザ)

This flexible category can sometimes accommodate retirees with substantial financial resources.

- Duration: 6 months to 3 years

- Requirements:

- Proof of significant financial independence (typically assets exceeding ¥30 million/$200,000)

- Comprehensive health insurance

- Detailed retirement plan

- Often requires assistance from an immigration lawyer

4. Business Manager/Investor Visa (経営・管理ビザ)

For retirees willing to invest in or start a business in Japan.

- Duration: 1-5 years

- Requirements:

- Minimum investment of ¥5 million (approximately $35,000)

- Business plan

- Physical office space

- Potential to employ Japanese nationals

5. Student Visa (留学ビザ)

Some retirees initially enter on a student visa while studying Japanese language or culture.

- Duration: 6 months to 4 years

- Requirements:

- Enrollment in a recognized educational institution

- Proof of financial support

- Note: This is generally a temporary solution, not a long-term retirement strategy

Path to Permanent Residency

Many American retirees aim for permanent residency in Japan as their ultimate goal:

- Basic Requirements:

- 10 years of legal residence in Japan (reduced to 3 years if married to a Japanese national)

- Financial stability and independence

- No criminal record

- Tax compliance

- Contribution to Japanese society

- Application Process:

- Gather documentation (residence records, tax certificates, income verification)

- Submit application to the Immigration Bureau

- Interview with immigration officials

- Wait period (typically 6-12 months)

- Benefits of Permanent Residency:

- No need for visa renewals

- Freedom to work in any field

- Access to national pension and healthcare systems

- Ability to leave and re-enter Japan freely

Japanese Citizenship Considerations

Some long-term retirees consider naturalization, though this comes with significant implications:

- Key Requirements:

- 5+ years of residency

- Age 20 or older

- Good moral character

- Financial independence

- Willingness to renounce current citizenship (Japan doesn’t recognize dual citizenship)

- Important Note: Obtaining Japanese citizenship requires renouncing U.S. citizenship, which has significant tax, inheritance, and travel implications that should be carefully considered.

Documentation Requirements Checklist

When applying for any long-term visa or residency in Japan, prepare these essential documents:

| Document Type | Details | Notes |

|---|---|---|

| Valid Passport | At least 6 months validity | Multiple blank pages recommended |

| Visa Application Forms | Specific to visa type | Available from Japanese embassy |

| Financial Documentation | Bank statements, pension details, investment portfolios | Typically showing 2+ years of history |

| Income Verification | Tax returns, pension statements | Translated into Japanese |

| Health Insurance | Proof of comprehensive coverage | International or Japanese national insurance |

| Criminal Background Check | From your home country | Must be apostilled |

| Marriage Certificate | If applying via spouse visa | Translated and apostilled |

| Residence Certificate | Juminhyo (住民票) for those already in Japan | N/A for first-time applicants |

| Tax Certificates | Proof of tax compliance in Japan | For those already residing in Japan |

| Personal Statement | Explaining retirement plans | Should demonstrate ties to Japan |

Practical Tips for Visa Success

- Start early: Begin the visa application process at least 6-12 months before your planned retirement date.

- Consider a visa consultant: Japanese immigration procedures can be complex; professional guidance often proves invaluable.

- Establish a paper trail: Maintain detailed records of all visits to Japan, financial transactions, and relationships with Japanese nationals or institutions.

- Learn basic Japanese: While not strictly required, demonstrating Japanese language ability strengthens most visa applications.

- Visit first: Spend extended time in Japan before committing to retirement to ensure it meets your expectations.

“The visa process for retiring in Japan isn’t straightforward, but with adequate financial resources and careful planning, Americans can find viable pathways to long-term residency.” – Common sentiment among successful American retirees in Japan

The lack of a dedicated retirement visa for Japan means that careful planning and often substantial financial resources are necessary. However, thousands of Americans have successfully navigated these requirements to enjoy their retirement years in this culturally rich and safe country.

Financial Planning for Retirement in Japan

Retiring in Japan requires careful financial planning, especially since there’s no dedicated retirement visa that allows Americans to live there based solely on their retirement status.

Instead, you’ll need to demonstrate financial independence through substantial savings and ongoing income sources.

Cost of Living Comparison: Urban vs. Rural Japan

The cost of living in Japan varies dramatically depending on location. Tokyo consistently ranks among the world’s most expensive cities, while rural areas can be surprisingly affordable.

Urban Japan (Monthly Expenses)

| Expense Category | Tokyo/Osaka (USD) |

|---|---|

| Rent (1-bedroom) | $800-1,500 |

| Utilities | $150-200 |

| Groceries | $300-400 |

| Transportation | $100-150 |

| Healthcare premium | $50-100 |

| Entertainment | $200-300 |

| Total | $1,600-2,650 |

Rural Japan (Monthly Expenses)

| Expense Category | Rural Areas (USD) |

|---|---|

| Rent (1-bedroom) | $350-700 |

| Utilities | $120-180 |

| Groceries | $250-350 |

| Transportation | $50-100 |

| Healthcare premium | $40-80 |

| Entertainment | $100-200 |

| Total | $910-1,610 |

“The difference between retiring in Tokyo versus a town in Hokkaido or Kyushu can mean stretching your retirement savings by 5-10 years.”

Social Security and Retirement Income

Social Security Benefits

As an American retiree in Japan, you can continue receiving your Social Security benefits through direct deposit to a U.S. bank account or, in some cases, to a Japanese bank account. The average Social Security benefit (approximately $1,500-1,800 monthly) may cover basic expenses in rural areas but will likely be insufficient in major cities.

Income Requirements

While Japan doesn’t specify a minimum income requirement for retirees specifically, those applying for long-term residency should demonstrate monthly income of at least ¥250,000 ($1,700-2,000) per person to be considered financially stable.

Currency Exchange Impacts

The yen-dollar exchange rate can significantly impact your retirement finances in Japan. Consider these strategies to mitigate exchange rate risks:

- Maintain accounts in both currencies: Keep 3-6 months of expenses in yen

- Time your larger currency conversions when exchange rates are favorable

- Consider forward contracts for locking in exchange rates

- Diversify income sources across different currencies

A 10% fluctuation in exchange rates can dramatically affect your purchasing power, potentially adding or subtracting thousands from your annual budget.

Retirement Savings Requirements

For a comfortable retirement in Japan, financial planners typically recommend:

- Minimum savings: $250,000-500,000 (depending on lifestyle and location)

- Monthly income: $2,000-3,500 (including Social Security, pensions, and investment income)

- Emergency fund: At least $10,000-15,000 accessible in yen

Most successful American retirees in Japan maintain investment portfolios that generate consistent income while preserving capital.

Healthcare Costs in Japan

Japan’s healthcare system is often cited as a primary reason Americans consider retiring there. The National Health Insurance (NHI) system provides coverage to residents, including foreign nationals with proper visas.

Healthcare Cost Breakdown:

- Monthly premiums: ¥5,000-15,000 ($35-100) depending on income

- Co-payment rate: 30% for most services (10-20% for seniors over 75)

- Annual physical: ¥5,000-10,000 ($35-70)

- Specialist visit: ¥3,000-8,000 ($20-55) after insurance

- Hospital stay: ¥10,000-30,000 ($70-200) per day after insurance

Many American retirees maintain international health insurance for the first year until they qualify for NHI, which typically costs $200-400 monthly depending on age and coverage.

Tax Obligations for American Expats

American citizens must continue filing U.S. tax returns regardless of where they live, making retirement in Japan somewhat tax-complex.

U.S. Tax Considerations:

- Foreign Earned Income Exclusion: Excludes up to $120,000 (2023) of foreign-earned income

- Foreign Tax Credit: Credit for taxes paid to Japan

- FBAR filing: Required for foreign accounts totaling over $10,000

- FATCA reporting: Additional reporting for assets over certain thresholds

Japanese Tax Considerations:

- Resident tax: 10% national + 0-10% local income tax

- Consumption tax: 10% (similar to sales tax)

- Property tax: 1.4-2.1% of assessed value if you purchase property

- Inheritance tax: 10-55% progressive rate (applies to worldwide assets for long-term residents)

The U.S.-Japan Tax Treaty prevents double taxation, but you’ll need a tax professional familiar with both systems to optimize your tax situation.

Financial Planning Tips for Prospective Retirees

- Start planning 5-10 years before your intended retirement date

- Visit Japan multiple times during different seasons to understand living costs

- Consult with financial advisors who specialize in expatriate retirement

- Establish banking relationships in both countries

- Create a detailed budget accounting for healthcare, housing, and travel

- Consider long-term care needs and how they might be addressed in Japan

- Research pension portability if you have employer pensions

Bottom line: While retiring in Japan is financially feasible for Americans with adequate resources, it requires substantially more planning and likely more assets than retirement in many other popular expatriate destinations in Southeast Asia.

Healthcare System and Insurance for Retirees in Japan

Japan’s healthcare system consistently ranks among the best in the world, making it an attractive feature for Americans considering retirement in the country. As a retiree, understanding how to access and pay for healthcare services is essential for long-term planning.

National Health Insurance (NHI) System

Japan operates on a universal healthcare system called Kokumin Kenko Hoken (National Health Insurance or NHI). All residents in Japan, including foreign nationals staying for more than three months, are required to enroll in either the NHI or an employer-sponsored health insurance plan.

For retirees, the NHI is typically the most appropriate option. Under this system, you’ll receive:

- Coverage for 70% of medical costs (meaning you pay 30%)

- Access to any medical facility in Japan

- Coverage for most medical procedures, treatments, and prescription medications

The monthly premiums for NHI are calculated based on your income from the previous year, property assets, and the number of family members covered. For retirees with modest incomes, premiums typically range from ¥10,000 to ¥40,000 ($70-$280) per month.

Eligibility for Foreign Retirees

As an American retiree in Japan, you become eligible for the NHI system once you:

- Obtain a residence card (zairyu card)

- Register at your local municipal office

- Have a visa status allowing stays of more than three months

It’s important to note that you must enroll in the NHI within 14 days of establishing residency in Japan. The enrollment process takes place at your local city hall or ward office.

Coverage Details and Benefits

The NHI provides comprehensive coverage that includes:

- Doctor consultations and examinations

- Emergency care

- Hospitalization

- Surgery and treatments

- Dental care (basic procedures)

- Prescription medications

- Some preventive screenings

For seniors aged 70-74, the copayment rate is reduced to 20% (from the standard 30%), meaning the insurance covers 80% of costs.

Those 75 and older are automatically transferred to the Late-Stage Elderly Healthcare System, which maintains the same 20% copayment rate but may have different premium calculations.

Out-of-Pocket Costs

While the 70/30 coverage split might initially seem concerning, Japan has implemented several safeguards to prevent excessive medical expenses:

- High-Cost Medical Expense System (Kogaku Ryoyo-hi): This program caps monthly out-of-pocket expenses based on income. Once you exceed the monthly threshold (typically ¥80,000-¥250,000 or $550-$1,700), you pay only a small fixed amount for additional care that month.

- Fixed-price services: Many routine procedures have government-mandated prices, making healthcare costs predictable and reasonable compared to the U.S.

A typical doctor’s visit might cost ¥3,000-¥5,000 ($20-$35) out-of-pocket after insurance, while more specialized care or tests will cost more but remain significantly less than U.S. prices.

Private Insurance Options

While the NHI provides excellent coverage, some American retirees opt for supplemental private insurance to cover:

- The 30% copayment portion

- Services not covered by NHI (certain advanced treatments)

- Private hospital rooms

- Medical evacuation to the U.S. if needed

Popular options include:

| Insurance Type | Typical Monthly Cost | Key Benefits |

|---|---|---|

| International Health Insurance | ¥15,000-¥40,000 ($100-$280) | Worldwide coverage, English documentation |

| Japanese Private Insurance | ¥5,000-¥20,000 ($35-$140) | Tailored to local healthcare system |

| Travel Insurance (short-term) | Varies by duration | Temporary coverage during initial settlement |

Many retirees find that the NHI coverage is sufficient without supplemental insurance, especially given the high quality and low cost of Japanese healthcare.

Healthcare Quality for Seniors

Japan’s healthcare system is particularly well-suited for seniors due to:

- Longevity focus: Japan has the world’s highest life expectancy, and its healthcare system is designed with elderly care in mind.

- Preventive care: Regular check-ups and screenings are emphasized and affordable.

- Geriatric specialization: Many medical facilities have dedicated geriatric departments.

- Long-term care insurance: A separate mandatory insurance system for those 40 and older that covers nursing care and support services.

The Long-term Care Insurance (Kaigo Hoken) system deserves special mention. For those 65 and older who require nursing care or daily assistance, this system provides services at 10% of the actual cost (you pay just 10%, the system covers 90%). This can include home helpers, day services, short stays at care facilities, and even home modifications.

Language Barriers in Healthcare

The language barrier presents one of the biggest challenges for American retirees accessing healthcare in Japan. While medical care is excellent, English proficiency among healthcare providers varies significantly:

- Major urban hospitals: Often have some English-speaking staff and interpreters

- Rural clinics: Typically have limited English capabilities

- University hospitals: Generally better equipped for international patients

- International clinics: Available in major cities but may not accept NHI

To overcome language barriers:

- Learn basic medical Japanese phrases and vocabulary

- Use medical translation apps like Medical Translator or Japan Healthcare Info

- Consider services like AMDA International Medical Information Center, which provides telephone interpretation services

- Build relationships with English-speaking doctors before emergency situations arise

- Carry a medical information card in Japanese listing conditions, medications, and allergies

Some cities with larger foreign populations have established support systems for non-Japanese speaking residents. For example, Yokohama and Tokyo offer medical interpreter services through their international associations, sometimes at no cost to residents.

Preparing for Healthcare Needs

Before retiring to Japan, consider these healthcare preparation steps:

- Gather medical records and have important documents translated into Japanese

- Research healthcare facilities near your intended residence with English capabilities

- Establish a relationship with a primary care physician soon after arrival

- Learn the emergency medical system (dial 119 for ambulance)

- Create a healthcare emergency plan including contacts and preferred hospitals

With proper planning and understanding of the system, American retirees can enjoy high-quality, affordable healthcare that often exceeds what they might receive in the United States, despite the occasional language challenges.

Housing Options and Best Locations for American Retirees

Securing comfortable and affordable housing is one of the most important decisions you’ll make when retiring in Japan. Your choice will significantly impact your quality of life, budget, and integration into Japanese society.

Renting vs. Buying Property as a Foreigner

Renting in Japan offers flexibility and fewer upfront costs, making it the preferred option for many American retirees. The rental process typically involves:

- Working with a real estate agent (不動産屋, fudōsan-ya)

- Paying key money (reikin) – a non-refundable “gift” to the landlord (typically 1-2 months’ rent)

- Security deposit (shikikin) – usually 1-2 months’ rent

- Guarantor requirements (often resolved through guarantor companies for a fee)

- Lease renewal fees every 1-2 years

Rental prices vary dramatically based on location, with Tokyo apartments commanding premium prices while rural areas offer significant savings.

Buying property is possible for foreigners in Japan with no legal restrictions on ownership. However, consider these factors:

- Property in Japan typically depreciates rather than appreciates

- Older homes lose value significantly, with many properties considered worthless after 30 years

- Obtaining mortgages can be challenging for foreigners, especially retirees

- New builds maintain value better than older properties

- Annual property taxes are relatively low (approximately 1.4% of the assessed value)

For most American retirees, renting provides greater flexibility and fewer complications, particularly if you’re unsure about making Japan your permanent home.

Popular Retirement Locations for Americans

Japan offers diverse retirement options depending on your lifestyle preferences, budget, and desired climate:

Okinawa: The Tropical Paradise

Okinawa has become increasingly popular among foreign retirees for good reason:

- Subtropical climate with warm weather year-round

- Relaxed pace of life compared to mainland Japan

- Lower cost of living than Tokyo or Osaka

- Beautiful beaches and natural scenery

- Established expat community

- Known for longevity and healthy lifestyle

Naha City offers urban conveniences, while smaller towns like Yomitan provide a more laid-back atmosphere with lower housing costs.

Kyoto: Cultural Immersion

Kyoto appeals to retirees seeking traditional Japanese culture:

- Rich historical heritage with over 1,600 Buddhist temples and 400 Shinto shrines

- Four distinct seasons with beautiful cherry blossoms and autumn colors

- Walkable city with excellent public transportation

- Sophisticated cultural scene with museums, theaters, and traditional arts

- More affordable than Tokyo while maintaining urban amenities

- Excellent healthcare facilities

The outskirts of Kyoto offer more affordable housing while maintaining easy access to the city center.

Yokohama: Modern Convenience with International Flair

Yokohama provides an excellent balance for American retirees:

- Close proximity to Tokyo (30 minutes by train) with lower housing costs

- Significant international community and English-speaking services

- Modern amenities and Western-style housing options

- Scenic waterfront areas and parks

- Excellent medical facilities with some English-speaking staff

- International restaurants and shopping

The Yamate district is particularly popular among foreign residents due to its international atmosphere and Western-style houses.

Other Notable Retirement Destinations

- Fukuoka: Mild climate, affordable living, and international connections to Asia

- Kobe: Cosmopolitan port city with a significant expat history and Western influences

- Kamakura: Coastal town with historical sites and relaxed atmosphere near Tokyo

- Sapporo: Cool climate, winter sports, and lower cost of living

Cost Comparison by Region

Housing costs vary dramatically across Japan:

| Region | Average Monthly Rent (1BR apt) | Average Purchase Price (per sq. meter) |

|---|---|---|

| Tokyo | $1,000-1,800 | $8,000-15,000 |

| Yokohama | $800-1,200 | $6,000-10,000 |

| Kyoto | $600-1,000 | $5,000-9,000 |

| Fukuoka | $500-800 | $3,500-6,000 |

| Okinawa | $450-700 | $3,000-5,000 |

| Rural Areas | $300-500 | $1,500-3,000 |

Note: Prices are approximate and can vary significantly based on exact location, property age, and amenities.

Accessibility Considerations for Retirees

When selecting housing in Japan, consider these age-friendly factors:

- Building structure: Many older Japanese apartments lack elevators and may have steep stairs

- Bathroom design: Traditional Japanese bathrooms often have high steps into the bath

- Heating systems: Older properties may lack central heating, relying instead on space heaters

- Proximity to medical facilities: Rural areas offer lower costs but may have limited healthcare access

- Public transportation access: Crucial for maintaining independence as you age

- Walkability: Consider neighborhood hills, sidewalk availability, and distance to essential services

Modern apartments and houses built specifically for older residents (silver housing) increasingly incorporate universal design principles.

Retirement Communities and Support Networks

While Japan doesn’t have the same concept of retirement communities as the United States, several options exist:

- Service apartments (sābisu tsuki manshon): Apartments with optional support services

- Senior living facilities: Ranging from independent living to full nursing care

- Foreign-friendly retirement developments: Emerging in areas popular with expats

- Expat organizations: Provide social connections and practical support

- Local community centers (kōminkan): Offer activities and social opportunities for seniors

“We chose Kamakura for our retirement because it offers the perfect balance—close enough to Tokyo for big-city amenities but with a relaxed coastal vibe. Housing costs are reasonable, and there’s a small but supportive expat community.” — American retiree in Japan

Making Your Housing Decision

When evaluating potential retirement locations in Japan:

- Visit during different seasons before committing

- Rent short-term initially before making long-term commitments

- Consider proximity to airports for visits from family and friends

- Research healthcare facilities with English-speaking staff

- Evaluate the local expat community for potential support networks

- Consider future needs as you age, including accessibility and care options

Your housing choice will significantly impact your retirement experience in Japan, so take time to explore different regions and property types before making your decision.

Cultural Adaptation and Language Considerations

Retiring in Japan offers an immersive cultural experience, but it also presents significant adaptation challenges. Understanding and navigating these cultural differences is essential for a fulfilling retirement experience in the Land of the Rising Sun.

Language Barriers

The language barrier represents perhaps the most significant challenge for American retirees in Japan. While English is taught in Japanese schools and some younger Japanese people speak basic English, the overall English proficiency across Japan remains limited, especially among older generations and in rural areas.

In daily life, you’ll encounter numerous situations where Japanese is essential:

- Doctor’s appointments and hospital visits

- Banking and financial transactions

- Government offices and paperwork

- Shopping in local markets

- Establishing relationships with neighbors

- Emergency situations

Many retirees report that even in Tokyo and other major cities, navigating daily life without Japanese language skills can be isolating and frustrating. Simple tasks like reading mail, understanding utility bills, or asking for directions can become complicated challenges.

The Importance of Learning Basic Japanese

While achieving fluency in Japanese is a significant undertaking, learning basic conversational Japanese is highly recommended for anyone planning to retire in Japan. Even rudimentary language skills can:

- Demonstrate respect for the local culture

- Help build relationships with neighbors and community members

- Enable you to handle everyday interactions independently

- Reduce stress and frustration in daily activities

- Open doors to deeper cultural experiences

Many successful retirees in Japan begin learning the language years before their move. Starting with basic greetings, numbers, and everyday phrases can create a foundation that you can build upon after arrival.

Resources for Language Learning:

- Online courses: Platforms like Duolingo, Rosetta Stone, and JapanesePod101

- Community classes: Many Japanese cities offer affordable language classes for foreigners

- Language exchange: Connecting with Japanese people interested in practicing English

- Private tutors: For personalized instruction and conversation practice

- Smartphone apps: For on-the-go learning and practice

Navigating Cultural Norms and Etiquette

Japanese society operates with distinct social codes that may differ significantly from American customs. Understanding these cultural norms can help you integrate more smoothly:

Key Cultural Considerations:

- Group harmony (wa) – Japanese culture prioritizes group harmony over individual expression. This manifests in consensus-building, conflict avoidance, and consideration for others.

- Respect for hierarchy – Age, position, and seniority are important in Japanese social interactions.

- Indirect communication – Direct refusals or criticisms are often avoided in favor of more subtle expressions.

- Gift-giving culture – Small gifts are commonly exchanged when visiting homes or during certain occasions.

- Removing shoes – Always remove shoes when entering homes and certain establishments.

- Bowing customs – Understanding basic bowing etiquette shows respect.

- Table manners – Specific customs exist around eating, including proper chopstick use and expressions of gratitude before and after meals.

- Punctuality – Being on time is highly valued and expected.

Many retirees find that observing local customs and making sincere efforts to adapt goes a long way in building positive relationships with Japanese neighbors and community members.

Integration Challenges

Even with language skills and cultural awareness, integration into Japanese society presents unique challenges for foreign retirees:

- Age of retirement community: The Japanese elderly population tends to be very active but has established social circles.

- Outsider status: Foreigners (gaijin) may always be viewed somewhat as outsiders, regardless of language proficiency or time spent in Japan.

- Different communication styles: American directness can sometimes clash with Japanese indirectness.

- Limited diversity in rural areas: Smaller communities may have less exposure to foreigners and different cultural perspectives.

- Technological barriers: Japan’s mix of cutting-edge technology and traditional systems can be confusing.

Expat Communities and Support Networks

Many American retirees find balance by connecting with both local Japanese communities and expat networks:

Expat Resources:

- Foreign Residents’ Associations: Many cities have organizations specifically for foreign residents

- International Women’s Clubs: Social and support groups in major cities

- Religious communities: Churches, temples, and other religious organizations often have English-speaking services

- Alumni clubs: University alumni associations often have chapters in Japan

- Professional organizations: Business and professional networks with international members

- Online communities: Facebook groups and forums specifically for expats in Japan

These communities can provide practical support, social connections, and a space to share experiences with others who understand the unique challenges of retiring in Japan.

Building a Bicultural Retirement

The most successful American retirees in Japan often develop a bicultural approach to their new life—embracing Japanese customs while maintaining connections to their American identity. This balanced approach might include:

- Participating in local festivals and community events

- Joining neighborhood associations (chōnaikai)

- Volunteering in the community

- Sharing American customs with Japanese friends

- Maintaining connections with family and friends in the U.S.

- Creating new traditions that blend both cultures

By approaching cultural differences with curiosity, patience, and humility, many retirees find that the process of adaptation becomes one of the most rewarding aspects of their retirement in Japan.

Legal and Practical Matters for Retiring in Japan

Retiring in Japan requires navigating various legal and practical considerations that differ significantly from the American system. Understanding these differences in advance can help you avoid complications and ensure a smoother transition to your new life.

Banking and Money Transfers

Setting up reliable financial systems is crucial for expatriate retirees in Japan. Most American retirees maintain both U.S. and Japanese bank accounts.

Japanese Banking Options:

- Major international banks with English services (SMBC, MUFG, Mizuho)

- Online banks like Sony Bank and Rakuten Bank (some English support)

- Japan Post Bank (widespread but limited English services)

Most Japanese banks require:

- Residence card

- Personal seal (hanko)

- Proof of address

- Tax identification number

Money Transfer Solutions:

- Traditional wire transfers (expensive but secure)

- Online services like Wise (formerly TransferWise) or OFX (better exchange rates)

- Multi-currency accounts to minimize conversion fees

Pro Tip: Set up automatic transfers for your Social Security or pension payments to minimize transaction fees and exchange rate fluctuations.

Estate Planning and Inheritance Laws

Japan’s inheritance laws differ significantly from American laws, potentially creating complications for retirees and their heirs.

Key Differences in Japanese Inheritance Law:

- Japan follows a forced heirship system where certain relatives are entitled to a statutory share

- Japanese inheritance tax applies to worldwide assets for residents

- Tax rates range from 10% to 55% depending on the amount inherited

Essential Estate Planning Steps:

- Create a will in both countries that complies with both legal systems

- Consider establishing a trust for more complex asset distribution

- Document all assets in both countries

- Designate executors familiar with both Japanese and U.S. systems

The U.S.-Japan Estate and Gift Tax Treaty helps prevent double taxation, but professional guidance is strongly recommended due to the complexity.

Healthcare Proxies and End-of-Life Planning

Planning for potential health emergencies and end-of-life care is particularly important when retiring abroad.

Recommended Documents:

- Healthcare proxy (translated into Japanese)

- Living will or advance directive

- Power of attorney for both healthcare and financial matters

- STEP documents (Society of Trust and Estate Practitioners)

These documents should be prepared in both English and Japanese, properly notarized, and kept accessible to trusted individuals in both countries.

Driving in Japan

For retirees accustomed to driving, understanding Japan’s road rules is essential.

Driver’s License Options:

- International Driving Permit (IDP): Valid for only one year

- Converting your U.S. license: Requirements vary by state, but typically include:

- Written exam (available in English)

- Eye exam

- Proof of driving experience

- Translation of your U.S. license

Considerations:

- Japan drives on the left side of the road

- Road signs use international symbols but may include Japanese text

- Urban areas have excellent public transportation, reducing the need for a car

Technology and Utilities Setup

Setting up your home utilities and technology infrastructure requires navigating systems that may differ from those in the U.S.

Essential Services:

- Electricity: Regional monopolies like TEPCO in Tokyo

- Gas: City gas in urban areas, propane in rural locations

- Water: Managed by municipal governments

- Internet: Major providers include NTT, SoftBank, and KDDI

- Mobile phones: Major carriers are Docomo, au, and SoftBank

Payment Methods:

- Most utilities are paid via automatic bank withdrawals

- Konbini (convenience store) payments are common alternatives

- Some services offer credit card payment options

Emergency Services Access

Understanding how to access emergency services is critical for retirees.

Emergency Numbers:

- 119: Fire and ambulance

- 110: Police

- 118: Coast guard

Language Barriers:

- Some areas have multilingual emergency services

- Consider registering with the U.S. Embassy for emergency assistance

- Apps like Japan Emergency provide translation for emergency situations

Medical Emergency Preparation:

- Carry a medical information card in Japanese

- Know the location of international hospitals near your residence

- Consider joining JMIP (Japan Medical Information Platform) for English-speaking healthcare support

Tax Compliance

Living in Japan requires managing tax obligations in both countries.

U.S. Tax Requirements:

- U.S. citizens must file annual tax returns regardless of residence

- Foreign Earned Income Exclusion may apply

- Foreign tax credits can help avoid double taxation

- FBAR filing required for foreign accounts over $10,000

Japanese Tax Considerations:

- Residents are taxed on worldwide income

- Non-permanent residents (first five years) may have limited taxation

- Annual tax returns (kakutei shinkoku) due February-March

Maintaining proper tax compliance in both countries is essential to avoid penalties and ensure financial stability during retirement.

Common Challenges and How to Overcome Them

Retiring in Japan offers a unique and enriching experience, but it’s not without significant hurdles. Understanding these challenges beforehand can help you develop effective strategies to overcome them and enjoy a fulfilling retirement in the Land of the Rising Sun.

Visa Limitations

Perhaps the most significant obstacle for American retirees is Japan’s lack of a dedicated retirement visa. Unlike countries such as Malaysia, Thailand, or Portugal that actively court foreign retirees with special visa programs, Japan requires alternative pathways.

Challenge: Without a specific retirement visa, Americans must qualify for other visa categories, each with strict requirements.

Solution:

- Consider the Long-Term Resident visa (for those with special ties to Japan) or the Highly-Skilled Professional visa (if you have valuable skills or business experience)

- Explore the Designated Activities visa if you have significant financial resources

- If you have Japanese ancestry, investigate the Spouse or Child of Japanese National visa

- Plan for a multi-year approach to permanent residency, which typically requires 10 years of residency (potentially reduced to 3 years for those who meet special criteria)

Language Barriers

While English signage is common in major cities, the language barrier remains substantial in day-to-day life.

Challenge: Limited Japanese language skills can complicate everything from healthcare appointments to utility services and social integration.

Solution:

- Begin learning Japanese before your move (focus on practical phrases and healthcare terminology)

- Enroll in language schools upon arrival – many offer senior-friendly courses

- Use technology tools like Google Translate for immediate assistance

- Join language exchange groups to practice with locals

- Consider locations with larger expatriate communities where English services are more readily available

Cultural Isolation

The cultural differences between America and Japan run deep, potentially leading to feelings of isolation.

Challenge: Cultural norms regarding social interaction, community involvement, and even concepts of friendship differ significantly from Western expectations.

Solution:

- Connect with expatriate communities through organizations like the American Chamber of Commerce in Japan

- Join international clubs that welcome foreign residents

- Participate in community activities where language barriers are less important (gardening clubs, hiking groups)

- Maintain regular communication with family and friends back home

- Embrace technology for virtual socializing

- Consider living in areas with established foreign communities like Yokohama, Kobe, or certain Tokyo neighborhoods

Healthcare Navigation

While Japan’s healthcare system ranks among the world’s best, navigating it as a foreigner presents unique challenges.

Challenge: Language barriers in healthcare settings, understanding insurance coverage, and managing chronic conditions in a new system.

Solution:

- Register with English-speaking medical facilities (available in major cities)

- Carry a medical translation card with your conditions, medications, and allergies in Japanese

- Consider supplemental private insurance that includes translation services

- Establish relationships with healthcare providers before emergency situations arise

- Join healthcare-focused expatriate groups for recommendations and advice

Financial Management

Managing finances across two countries creates complexity for American retirees.

Challenge: Currency fluctuations, international banking fees, tax compliance in both countries, and managing retirement accounts remotely.

Solution:

- Work with financial advisors experienced in expatriate retirement planning

- Establish banking relationships with international banks operating in both countries

- Consider strategic timing for currency exchanges to minimize losses

- Implement a diversified investment strategy that accounts for currency risk

- Use specialized tax services familiar with the U.S.-Japan tax treaty

- Create contingency funds for unexpected expenses or currency fluctuations

Case Study: The Johnsons’ Successful Retirement Transition

Robert and Linda Johnson, both in their mid-60s, moved to Kamakura after decades of planning.

The Johnsons began their Japan retirement journey with extended stays as tourists, eventually identifying Kamakura as their ideal location due to its blend of traditional culture, proximity to Tokyo, and established expatriate community.

Their path to permanent residence involved:

- Initially using 90-day tourist visas for extended visits

- Robert securing a part-time English teaching position to qualify for a work visa

- Maintaining this status for five years while integrating into the community

- Successfully applying for permanent residency based on their established ties and financial stability

“The key was patience and flexibility,” says Robert. “We adapted our timeline and expectations repeatedly, but the end result was worth every adjustment.”

Practical Tips for Overcoming Retirement Challenges in Japan

- Start planning 5-10 years before your intended retirement date to build financial resources and explore visa options

- Create a comprehensive healthcare strategy including:

- Documentation of your medical history translated into Japanese

- Research on available treatments for any chronic conditions

- Identification of English-speaking medical facilities near your intended residence

- Develop a financial contingency plan that accounts for:

- Potential currency fluctuations affecting your fixed income

- Emergency funds for medical evacuation if needed

- Resources for potential relocation if retirement in Japan doesn’t meet expectations

- Build a support network before arrival through:

- Online expatriate forums specific to your intended region

- Connections with local international organizations

- Relationships with service providers who can assist with housing, healthcare, and daily needs

- Consider a “trial retirement” by:

- Spending 3-6 months in your target location before committing

- Testing different regions during different seasons

- Establishing connections with local resources and expatriate communities

- Prepare for cultural integration by:

- Studying Japanese customs and etiquette beyond basic language skills

- Learning about local community expectations and involvement

- Understanding the cultural context of healthcare, housing, and social services

The challenges of retiring in Japan are significant but not insurmountable. With thorough preparation, realistic expectations, and a flexible approach, Americans can successfully navigate these obstacles to enjoy the unique benefits of retirement in this fascinating country.

Action Plan: Steps to Plan Your Retirement in Japan

Planning your retirement in Japan requires careful preparation and a strategic approach. The following action plan outlines key steps to take in the years leading up to your move, helping you navigate the complex process with confidence.

Timeline for Preparation

5-10 Years Before Retirement:

- Begin researching visa options and requirements

- Start building your retirement savings with Japan’s cost of living in mind

- Consider investing in Japanese language courses

- Plan extended visits to potential retirement locations in Japan

3-5 Years Before Retirement:

- Consult with financial advisors specializing in expatriate finances

- Research healthcare options and insurance requirements

- Begin organizing important documents (birth certificates, marriage licenses, etc.)

- Establish connections with expatriate communities in your target areas

1-2 Years Before Retirement:

- Initiate the visa application process

- Arrange for the transfer of retirement funds and set up international banking

- Research housing options and potentially secure accommodation

- Create a detailed budget based on your chosen location in Japan

Financial Planning Checklist

- Calculate retirement income needs based on Japan’s cost of living

- Determine how Social Security benefits will be received while living abroad

- Establish relationships with banks that offer favorable international transfer rates

- Consider currency hedging strategies to protect against yen/dollar fluctuations

- Review tax obligations in both the U.S. and Japan

- Set up emergency funds accessible in both countries

- Investigate long-term care insurance options

Visa Application Strategy

- Identify your most viable visa pathway (family-related, long-term resident, investor, etc.)

- Gather required documentation:

- Proof of financial independence

- Health insurance coverage

- Criminal background check

- Valid passport with sufficient remaining validity

- Consider working with an immigration attorney specializing in Japanese immigration

- Prepare for potential interviews at Japanese consulates or embassies

- Understand the renewal process and path to permanent residency

Healthcare Planning

- Register with Japan’s National Health Insurance system upon arrival

- Research supplemental private insurance options for gaps in coverage

- Compile medical records and prescription histories

- Identify English-speaking healthcare providers in your chosen region

- Plan for prescription medication needs and equivalents available in Japan

- Consider long-term care needs and facilities

Housing Research

- Rental considerations:

- Budget (¥70,000-¥200,000/month depending on location and size)

- Lease terms and requirements for foreigners

- Key money and deposit expectations

- Purchase considerations:

- Legal restrictions for foreign buyers

- Property taxes and maintenance fees

- Resale potential and inheritance implications

- Location factors:

- Proximity to healthcare facilities

- Access to public transportation

- Availability of Western amenities if desired

- Climate preferences (from subtropical Okinawa to snowy Hokkaido)

Language Learning Resources

| Resource Type | Options | Benefits |

|---|---|---|

| Online Courses | Duolingo, Rosetta Stone, JapanesePod101 | Self-paced learning |

| Community Classes | Community centers, senior centers | Social interaction |

| Private Tutors | In-person or online via italki, Preply | Personalized instruction |

| Immersion Programs | Language schools in Japan | Rapid acquisition |

| Apps | Anki, Kanji Study, HelloTalk | Supplemental practice |

Professional Services to Consult

- Immigration Attorney

- Specializing in Japanese immigration law

- Experienced with retiree situations

- International Tax Advisor

- Knowledgeable about U.S.-Japan tax treaties

- Experienced with expatriate tax filing requirements

- Financial Planner

- Expertise in international retirement planning

- Understanding of currency exchange risks

- Real Estate Agent

- Experience working with foreign clients

- Knowledge of areas popular with expatriates

- Healthcare Consultant

- Familiarity with Japan’s healthcare system

- Ability to help navigate insurance options

Pro Tip: Join online expatriate forums and social media groups focused on retirement in Japan. These communities provide invaluable first-hand experiences and advice from those who have already made the transition.

Remember that retiring in Japan is a marathon, not a sprint. The more thoroughly you prepare and the earlier you begin, the smoother your transition will be. With proper planning, patience, and flexibility, your dream of retiring in Japan can become a fulfilling reality.